The rapid rise in home prices and the cost of borrowing has had a significant impact on homeowners and buyer hopefuls alike. Real estate investors are not excluded.

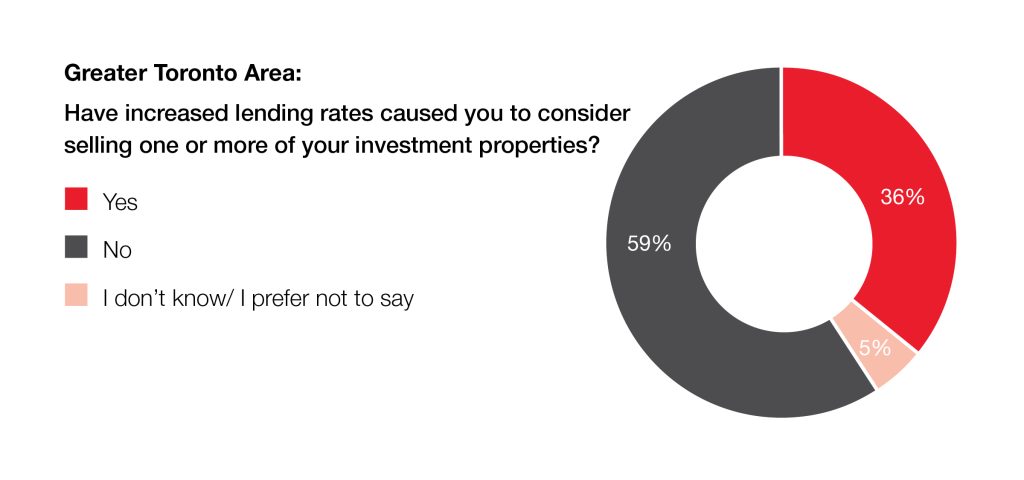

According to a recent Royal LePage survey conducted by Leger,1 36% of investors in the Greater Toronto Area say that increased lending rates have caused them to consider selling one or more of their investment properties, more than the national average of 31% and higher than the figures reported in the Greater Montreal Area (26%) and Greater Vancouver (28%). When asked about their plans for the future, 24% of investors in the region say they are likely to sell one or more of their investment properties within the next two years.

It’s important that an investor can withstand market downturns from time to time. During the pandemic, we saw some first-time investors enter the market when interest rates had dropped to record lows and home prices were beginning their upward climb. Fast-forward a year or two, and they are now faced with significantly higher borrowing costs, likely resulting in neutralized or decreased monthly income. Working with a real estate professional who understands the ins and outs of investing and can offer insights into the short- and medium-term outlook of the market can be supremely beneficial. Historically speaking, the GTA has been a thriving market for real estate investors. I imagine in the years to come, the region will continue to attract quality investors from all over.

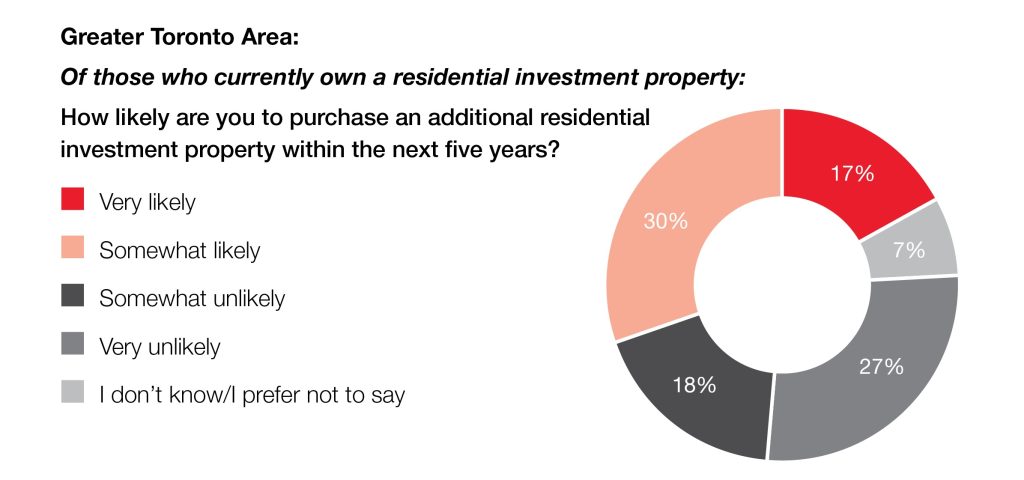

Some investors, however, remain optimistic about the future. 47% of investors in the GTA say that they are likely to purchase an additional residential investment property within the next five years – lower than the national average of 51% and the figures reported in the Greater Montreal Area (52%) and Greater Vancouver (54%).

Owning a home is part of the Canadian dream. While owning a primary residence is itself a viable investment, many Canadians look to real estate investing as a means to build financial security; the benefit of which is not only having a tangible asset and possibly monthly cashflow, but also the potential for appreciation over time. Consumers are becoming more educated on real estate investing, and their confidence and interest in the sector has increased in recent years. As the generation who grew up watching income property shows on HGTV, savvy millennials looking for opportunities to build generational wealth are a fast-growing segment of the GTA investor market.

Real estate should be considered a long-term investment that often requires waiting out temporary fluctuations in the market. Working with a real estate professional who understands the ins and outs of investing and can offer insights into the short- and medium-term outlook of the market can be supremely beneficial. Historically speaking, the GTA has been a thriving market for real estate investors. I imagine in the years to come, the region will continue to attract quality investors from all over.

Continue reading for more insights into the national real estate investor market.

1 An online survey of 1003 Canadians 18+, who own one or more residential investment properties, was completed between March 2, 2023, and March 17, 2023, using Leger’s online panel. No margin of error can be associated with a non-probability sample (i.e., a web panel in this case). For comparative purposes, though, a probability sample of 1003 respondents would have a margin of error of ±3%, 19 times out of 20. N.B.