Canadian consumers have been patiently waiting for interest rates and home prices to fall, especially those living in some of the country’s most expensive cities. This is certainly the case in Toronto and the GTA. Although more rate cuts are very likely to take place this year, the opportunity to take advantage of decreased monthly carrying costs is quickly coming to an end.

Royal LePage research shows that many would-be homebuyers are watching the Bank of Canada’s falling overnight lending rate as a signal to re-enter the market – 18% of sidelined homebuyers said they were waiting for a cut of 0.5% to 1.0% (50 to 100 basis points) before they would consider resuming their home search,1 while 23% said they’d need to see a cut of more than 1.0% (100 basis points). With two more interest rate announcements scheduled before the end of 2024, it is probable that the overnight rate will drop below 4%, triggering an early spring market as consumers with a renewed sense of confidence look to transact before home prices increase.

As mortgage rates drop, unit sales will continue to climb and home prices will undoubtedly increase in tandem. It’s important to note that even a small increase in prices has the potential to wipe out the savings gained from the lower interest rates we’ve all been eagerly anticipating. Those who are holding out for lending rates to drop further risk missing out on any savings available now before the wave of inevitable buyer demand arrives and home prices rise as a result.

The window of lower home prices is closing

Though lower interest rates can mean smaller monthly payments for existing mortgage holders, those shopping for a home in an environment where prices are on the rise will find that the savings recouped by lower rates will soon be eliminated by climbing home values.

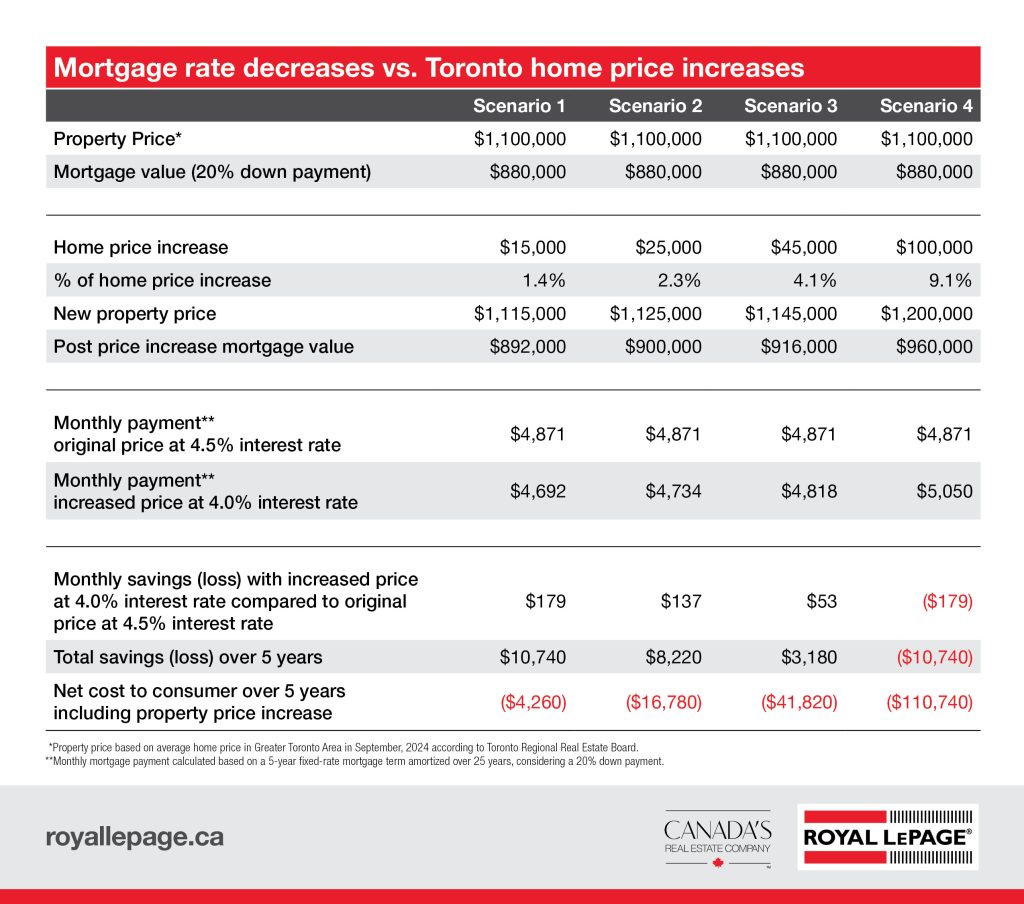

Let’s consider for example a Toronto home priced at $1.1 million financed today by a five-year fixed-rate mortgage at 4.5%, with a 20% down payment and amortized over 25 years. If that home increased by just $25,000 – that’s approximately 2.3% – while the mortgage rate decreased by 0.5% to 4.0% on the same five-year fixed-rate term, the buyer would still spend an additional $16,780 over the course of five years, despite slightly lower monthly payments. If the property were to increase more significantly – by $45,000 or 4.1% – the net additional cost over five years would exceed $41,000. Keep in mind, a very small portion of the monthly payment goes towards principal at the start of the life of a mortgage.

At a certain point, the monthly savings from lower interest rates give way to losses on account of the increased home price. In a scenario where the property increases by $100,000 or 9.1% under the same mortgage conditions, the homeowner will incur an additional monthly cost of $179, and spend an additional $110,740 over five years.

In an inevitable scenario of appreciating home prices, waiting for lower interest rates provides little or no financial tailwinds. Price appreciation has the power to outweigh the modest savings earned from lower lending rates.

Toronto home prices remain stable despite market turbulence

We know that many Toronto buyers are also waiting for lower listing prices. However, prices in the GTA have already experienced a correction from pandemic-era market highs, and large discounts are likely a thing of the past.

Despite 10 increases to the overnight lending rate over the past two years, Toronto home prices have remained somewhat flat, consistently averaging approximately $1.1 million, according to the Toronto Regional Real Estate Board, excluding the five months at the peak of the market in early 2022. High demand from newcomers for homes in Canada’s largest city has counteracted the softening effects of rate hikes from the past two years, avoiding a drastic decrease in home prices.

After a muted third quarter, the Toronto market is already showing signs of a busy fall as sales activity and prices have started to edge upward. In its latest Home Price Update, Royal LePage is forecasting that the aggregate price of a home in the Greater Toronto Area will increase 6.0% in the fourth quarter of 2024, compared to the same quarter last year,2 and will see a brisk spring housing market in 2025. With more rate cuts on the horizon, Toronto home prices are likely done treading water.

What’s next for the Toronto market?

For those considering a home purchase, the Toronto market may present opportunities for consumers sooner than later.

Waiting for rates to drop further as prices rise has the potential to cost buyers more money in the long run. In addition to the busy spring season, the reduced mortgage insurance cap and revised 30-year amortization rules recently announced by the federal government will make it easier for more buyers to enter the market, adding to demand. There are some great bargains to be had in the city’s resale condo market, which continues to see lower levels of activity and is currently flush with inventory, making conditions less competitive compared to other segments.

Though it can be tempting to try and time the market for the best possible deal, the tried and true mantra of real estate still stands: the best time to buy a home is when you are ready and can make the numbers work.

Want more insight on the Bank of Canada and the trajectory of interest rates? Learn more here.

1Half of sidelined homebuyers waiting for interest rate cuts to resume their purchase plans, Royal LePage Blog, February 2024

2Real estate rebound: Canada’s sluggish housing markets in recovery mode following third straight interest rate cut, Royal LePage, October 2024