Although inflation in Canada has been on the decline for several months, and while the Bank of Canada has now reduced its key overnight lending rate for the first time in more than four years, the cost of living – which includes housing-related expenses – remains high for many Canadian households relative to their incomes, so much so that some would be willing to move to another city to gain access to better affordability.

Quebec, a gem of affordability?

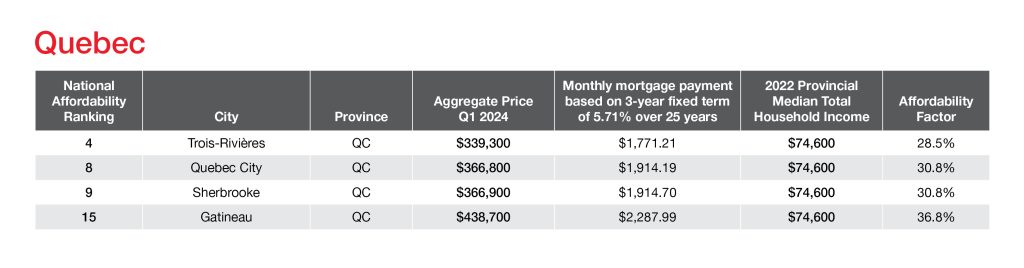

In a Royal LePage ranking of the 15 most affordable cities in Canada, four of the cities listed are located in Quebec.

Based on the percentage of income required to service a monthly mortgage payment, using provincial median household income1 data and city-level aggregate home price data,2 Trois-Rivières ranks fourth among the most affordable cities in Canada, and ranks first in the province of Quebec. The mortgage calculation is based on a three-year fixed-term loan at 5.71 per cent, amortized over 25 years with a 20 per cent down payment. In Trois-Rivières, 28.5 per cent of a household’s monthly income would be required.

“The Trois-Rivières region continues to attract buyers from all walks of life because of its affordability,” said Martin Leblanc, chartered real estate broker, Royal LePage Centre in Trois-Rivières. “Since the pandemic, the share of buyers from outside Trois-Rivières, particularly from the Montreal region, remains important. Demand extends to different property types, but is more pronounced in the condominium segment, which mainly attracts first-time buyers and retirees. Investment properties are also seeing increased demand, as they offer a better profitability ratio in Trois-Rivières for investors than in other, more densely populated regions in the province, especially with current interest rates. Trois-Rivières also offers a quiet, traffic-free environment. The market remains more favourable to first-time buyers, although home ownership has proven more difficult in recent years given higher interest rates and the rising cost of living.”

Quebec City is the next Quebec region on the list (8th position), followed by Sherbrooke (9th position) and Gatineau (15th position).

Montrealers ready to pack their bags

Meanwhile, a Royal LePage survey of residents in Canada’s three largest urban centers reveals that 54% of Greater Montreal residents polled said they would consider buying a property in a more affordable city, compared to 51% and 45% of respondents in Greater Toronto and Greater Vancouver, respectively. Quebec City would be the most popular city for Montrealers to move to, with 29% of respondents choosing the city, followed by Sherbrooke (15%), Trois-Rivières (12%) and Gatineau (12%). Respondents were allowed to select more than one city.

“The Quebec City region offers the best of both worlds: an urban setting in a picturesque setting, perfect for contemplation,” said Michèle Fournier, Vice President, Royal LePage Inter-Québec. “It’s the ideal place to start a family, with its wide choice of schools, variety of family activities and safe environment. Job opportunities are plentiful, particularly in the public service, as well as in the hospital and university networks. And let’s not forget the vast array of 4-season sports on offer. The region is known for its winter activities, of course, but it’s also renowned for its many golf courses. It’s no surprise that Quebec City tops the list of the most popular cities for Montrealers in search of affordability and a more balanced lifestyle.”

Beyond the dollar sign

In addition to housing prices, a lower cost of living is the reason most often cited (44%) by Montrealers for considering a move, followed by the desire to be close to nature (39%), having family or friends who currently live in one of these regions (28%) and the need to experience a more relaxed pace of life (25%).

Diverging trends between tenants and owners

According to the survey, Montreal renters are more likely (61%) to relocate than their homeowner neighbours (49%).

Read the full release below to find out more.

1Statistics Canada. Table 11-10-0190-01 Market income, government transfers, total income, income tax and after-tax income by economic family type, using 2022 provincial median total income of economic families and persons not in an economic family

2Royal LePage Q1 2024 House Price Survey, April 12, 2024