As the first buds timidly announce the arrival of spring, there’s a buzz in the air – the cottage market rush. This time of year awakens not only nature, but also the aspirations of those seeking a peaceful retreat, far from the hustle and bustle of urban life. Quebec’s recreational real estate market is about to enter a period of frenetic activity, buoyed by the anticipation of an early spring and more favourable borrowing conditions.

According to the Royal LePage 2024 Spring Recreational Property Report, which includes 15 markets in the province of Quebec, the imbalance between supply and demand continued to favour sellers over the past year in most Quebec resort markets, causing modest price appreciation, despite the difficult economic environment. The reduced purchasing power of buyers, brought on by repeated interest rate hikes over the past two years, was the main drag on more sustained price increases in recreational markets, while potential buyers remained on the sidelines until the economic horizon brightened.

“Property buyers’ patience was thoroughly tested in 2023, including in our resort markets,” explained Dominic St-Pierre, Senior Vice President, Business Development, Royal LePage. “With interest rates and the cost of living on the rise, households’ discretionary spending has been affected, and many people have put their plans to buy a primary or a secondary residence on hold, waiting for a more favourable mortgage environment before taking the next step. However, the early arrival of spring, combined with the expectation of a downward adjustment in interest rates over the coming months, should lead to a buoyant market this year.”

Price trends

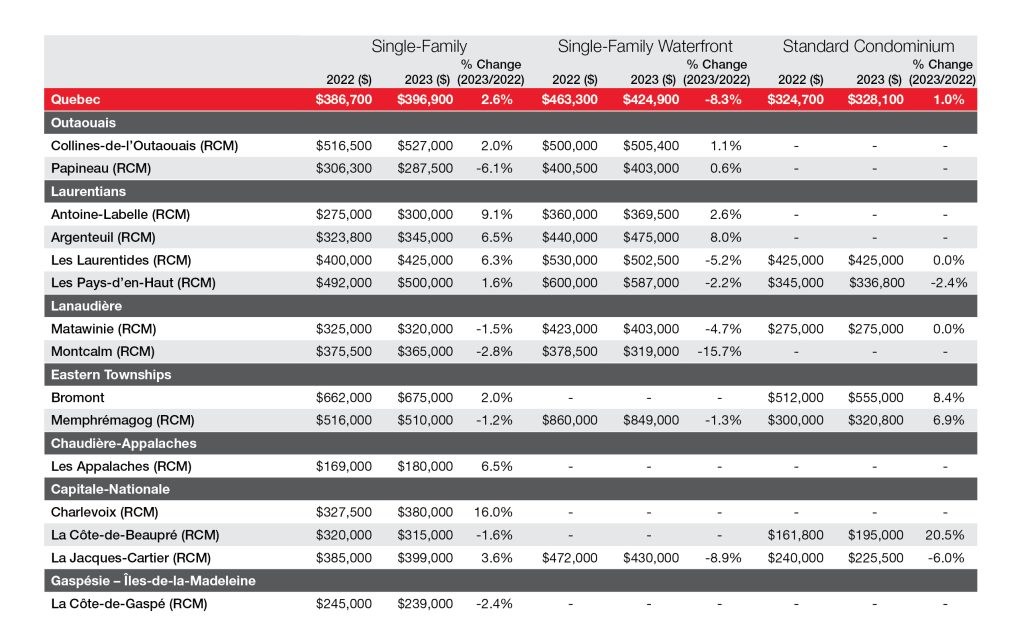

In 2023, the weighted median price1 of a single-family home in the province’s major recreational markets rose 2.6% year over year to $396,900. Over the same period, the weighted median price of a single-family waterfront property recorded an 8.3% decline to $424,900, while at the same time, the weighted median price of a standard condominium in recreational markets remained stable, increasing 1.0% in 2023, compared to 2022, to land at $328,100.

According to a survey of Royal LePage experts working in the province’s resort real estate markets,2 87% said that recreational property buyers require purchase financing. Meanwhile, when asked about the impact of expected interest rate cuts on demand for recreational properties in their region, 91% of respondents said they expect an increase in demand, including 10% who believe activity will increase significantly.

“You’d think that homebuyers in resort markets would be less concerned about interest rate fluctuations. However, the majority of recreational property buyers are financed, either for the full market value or for a fraction of it,” said St-Pierre. “The slowdown in buyer demand in these markets in 2023 was therefore also impacted by rising borrowing costs, which reached a 20-year high this year.”

Primary or secondary residence?

According to the survey, the majority of respondents (55%) said their clients use their properties as a second home, 19% said owners in their area live there year-round as their primary residence, 13% said the properties are used partly for vacation and partly for rental purpose to generate income, and 6% indicated that the properties are used solely as rental properties (short- or long-term) with the aim of generating income.

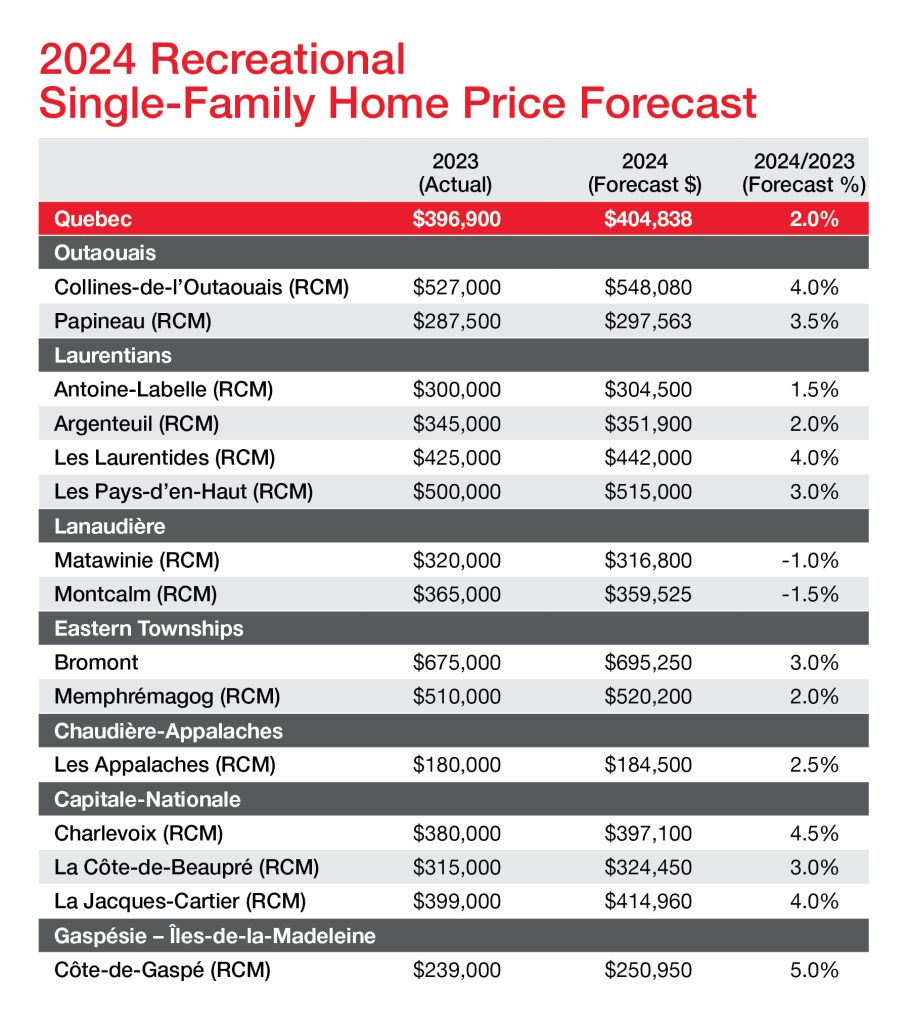

Forecast

As the downward adjustment in interest rates looks increasingly within reach in 2024, Royal LePage expects a resurgence in real estate demand in Quebec’s resort markets, namely from buyers who have been waiting for lower interest rates to return to the market to acquire a property. At the same time, sellers will be taking the opportunity to put their properties on the market, and will be trying to get the best possible price, relying on increased competition from buyers. This surge of activity is likely to occur early this spring, as winter weather has quickly given way to warmer temperatures.

“The modestly more favourable mortgage environment expected in 2024 should stimulate demand and price appreciation in our main recreational markets in Quebec, but we don’t expect values to soar this year,” said St-Pierre. “Interest rates remain above historical norms of the past 20 years. When rate cuts begin, even a small decrease will put further upward pressure on home prices. Supply will increase slightly, but should be quickly absorbed, as inventory remains insufficient to meet demand in all four corners of the province.”

St-Pierre added one caveat: “As we head towards the 2025 peak of mortgage renewals from residential real estate purchases made during the pandemic, it would not be surprising to see a cohort of homeowners put their properties up for sale early to reduce their indebtedness, even if it means downgrading to a more modest residence.

Highlights:

- In 2023, the weighted median price of a single-family home in Quebec’s major resort markets appreciated by 2.6% compared to 2022, to $396,900

- In the province, the weighted median price of a single-family waterfront property decreased 8.3% in 2023 versus 2022, to $424,900

- The weighted median price of a standard condominium in recreational regions studied remained stable, increasing 1.0% compared to 2022, to $328,100

- 91% of Royal LePage recreational property experts in the province expect activity in their market to intensify when the Bank of Canada lowers interest rates

- The end of financing for the purchase of properties in 0-20-year flood zones, effective February, 2024, is causing concern in some recreational areas of the province

- Royal LePage forecasts that the median price of a single-family home in Quebec’s recreational regions will increase 2.0% in 2024, compared to 2023, to $404,838

1Royal LePage’s provincial weighted median home prices are based on a weighted model using sales in each region. Methodology is consistent with previous reports, which used the label ‘aggregate’.

2A provincial online survey of 31 real estate professionals serving buyers and sellers in Quebec’s recreational property regions was conducted between February 24, 2024 and March 12, 2024.