2022 marked the end of the COVID-19 pandemic, or at least the mandatory health restrictions, and the conclusion of an unprecedented period of property price appreciation. Housing demand was halted by a series of seven consecutive interest rate hikes by the Bank of Canada between March and December of 2022. What followed was a price correction in the country’s national real estate market, and in several regional markets, which stands to erase price gains made in 2022.

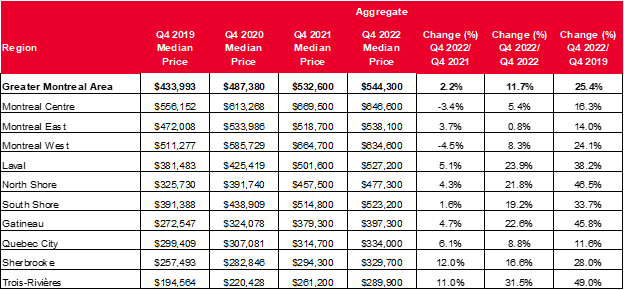

According to the Royal LePage House Price Survey and Market Survey Forecast, the fourth quarter of 2022 may well have been the last for year-over-year price increases in the Greater Montreal Area, marking an end to the exuberant home price increases of recent years. The price correction that began during the second quarter of 2022 is expected to erase the gains of the past year sometime during the first quarter of 2023 in most Greater Montreal Area markets, while the rate of price appreciation will end its year-over-year upward trajectory. However, markets outside Greater Montreal continued to post price increases, ranging from 4.7% to 12.0% year-over-year.

“Quebec’s regions and suburban areas attracted an unprecedented number of buyers during the pandemic, pushing the market value of properties to all-time highs,” said Dominic St-Pierre, vice president and general manager, Royal LePage, Quebec region. “Since the price correction is reaching the regional markets later than in Greater Montreal, we expect that the trend observed over the past three years will be reversed, and Montreal will once again see a greater demand than other regions. In Greater Montreal, we should see price stabilization followed by modest to moderate growth once interest rates start to come back down, possibly at the end of 2023 or in the first half of 2024.”

Although the price correction has undone most of the gains seen in 2022 in the Greater Montreal Area, those made since the fourth quarter of 2019 remain considerable. The potential resale profit for an owner who purchased during that period is as high as 25.4%, or $110,307, for a property with the current median price of $544,300. Furthermore, outlying areas have seen even greater gains from 2019 to 2022, with the North Shore leading the way at 46.5%. This confirms the strong demand for properties located closer to recreational activities, which began during the pandemic. Outside Montreal, Trois-Rivières and Gatineau recorded increases in the aggregate price of a home of 49.0% and 45.8% respectively, while Quebec City and Sherbrooke posted gains of 11.6% and 28.0% respectively.

“The current inflationary cycle is challenging for many households, especially after the holiday season,” St-Pierre added. “That said, and in spite of higher borrowing rates, property supply has returned to the levels we saw in late 2016, a time when the market was more balanced. Although prices are considerably higher than they were in 2016, buyers should have more options in 2023, along with more negotiating power.”

*Regional releases available in French only.