Ontario voters are heading back to the polls this week, and once again housing affordability is front and centre.

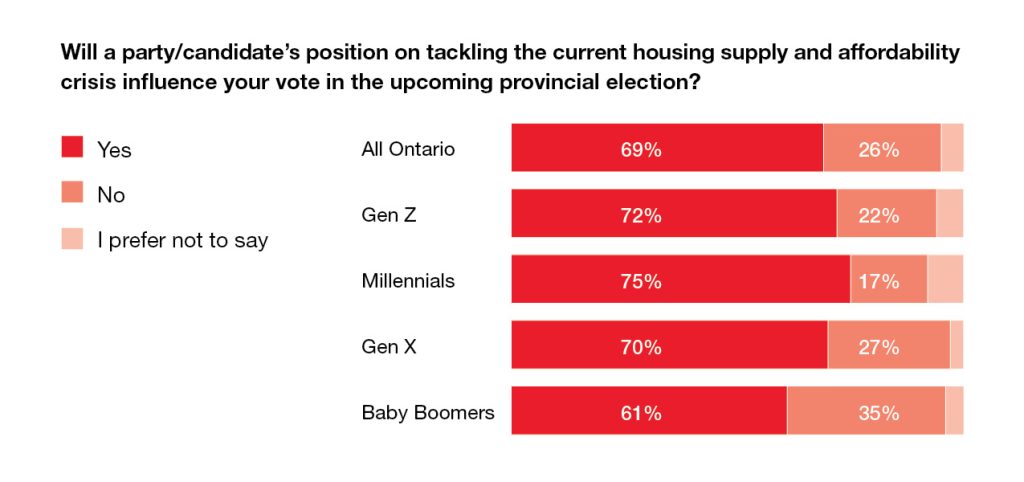

According to a recent Royal LePage® survey, conducted by Hill & Knowlton,1 69% of adults in Ontario say that a party or candidate’s position on tackling the current housing supply and affordability crisis will influence their vote. Not surprisingly, that figure is even higher among the younger generations (72% of generation Z and 75% of millennials), renters (73%), and those planning to purchase a home within the next two years (82%).

“Since the onset of the pandemic-induced real estate boom in 2020, housing affordability has been a growing concern, particularly in the country’s most expensive and supply-strapped markets – Toronto and Vancouver,” said Phil Soper, president and CEO, Royal LePage. “With affordability challenges reaching a crisis level, it comes as no surprise that voters – especially younger Canadians – are prioritizing housing policies as they head to the polls.

“While recent interest rate fluctuations and a temporary rise in inventory have created some market uncertainty, the underlying issue remains unchanged: a fundamental lack of supply. Sustainable affordability can only be achieved through a significant and sustained increase in housing construction.”

Soper added that concrete government action is required to improve housing supply. The next Ontario government will have a responsibility to work closely with municipalities to make housing more accessible for all.

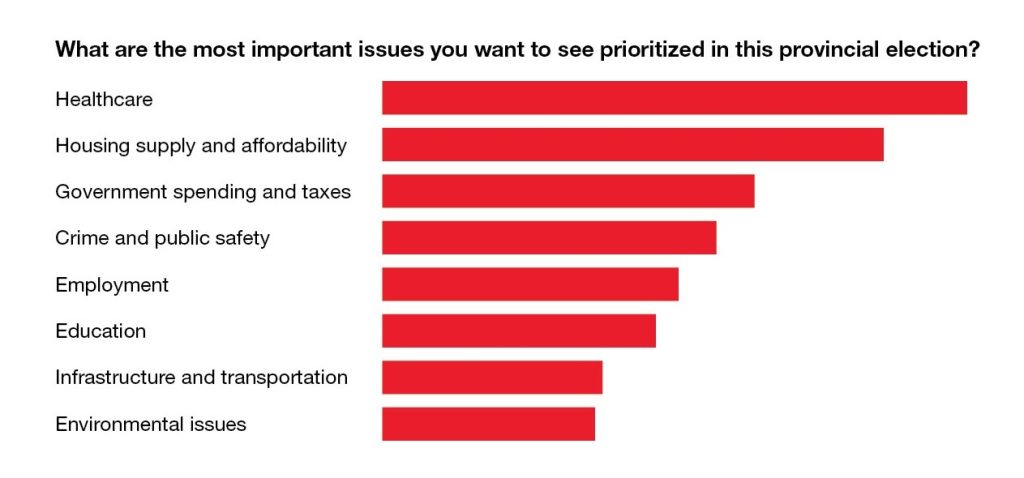

Voters have several major concerns which will define the outcome of this provincial election. When asked to identify the most important issues they’d like to see prioritized by the next Ontario government, 66% selected housing, second only to health care (77%), and above government spending and taxes (49%), crime and public safety (44%), employment (39%), and education (36%). Respondents were able to select more than one answer.

Housing affordability the #1 ballot box issue among young voters

Facing some of the highest property values in the country, housing accessibility and affordability are key voting concerns among young Ontario residents in the upcoming election. When asked to rank their top three priorities in order of importance, generation Z and millennials ranked housing supply and affordability as their top ballot box issue, followed by healthcare. Rounding out the top three, millennials selected government spending and taxes as their third-most important priority, while generation z selected employment. Meanwhile, healthcare remains the leading issue for generation X and baby boomers.

When it comes to getting a foot on the property ladder, young Ontarians are keen to transition into home ownership, despite mounting challenges. According to the Royal LePage 2024 Demographic Survey: Next Generation of Buyers report,2 released last summer, 82% of people in Ontario belonging to the adult generation Z and young millennial cohort3 said they believe home ownership is a worthwhile investment. Among non-homeowners in this cohort, 75% said that owning a home is a priority for them. However, less than half of Ontario respondents (47%) said they believe home ownership is an achievable goal, the lowest among all regions in Canada. Twenty-seven per cent said they do not believe it is achievable for them at all, and 26% were unsure.

Ontarians willing to take proactive measures to achieve home ownership goals

With housing affordability becoming increasingly challenging for many Ontario residents, some are prepared to take meaningful action in order to improve their chances of buying a home. Thirty-eight per cent of respondents say they would consider purchasing a home in a more affordable region within Ontario, 20% say they would consider relocating outside of Ontario and purchasing a home in a more affordable province, 18% say they would consider purchasing a home with a rental unit to subsidize their mortgage expenses, and 12% say they would consider purchasing a home with family or friends (someone other than their spouse). On the other hand, 32% say they would not consider any of these options. Respondents were able to select more than one answer.

Compared to older generations, young people living in Ontario are more likely to make a drastic move. To access more affordable housing options, 29% of generation Z respondents and 25% of millennials say they would consider relocating outside of Ontario, a higher proportion than those in generation X (20%) and baby boomers (10%).

According to the survey, 26% of Ontarians who do not own their primary residence are planning to buy a home within the next two years, and they are more likely than existing homeowners to consider one of these options to make their future purchase more affordable.

“Falling interest rates over the past year, combined with stable home prices and rising wages, have provided a temporary but meaningful improvement in housing affordability, particularly for first-time homebuyers. However, this reprieve is unlikely to last beyond 2025,” Soper continued. “Pent-up demand, fueled by years of constrained supply, combined with the ongoing need for housing in a growing country, will soon outpace available inventory. Without a significant and sustained increase in housing construction, affordability challenges will persist well into the future.”

Review the data chart for more information and generational insights:

Ontario residents head to the polls on February 27th. You can read about each major political party’s election platform using the links below:

1Hill & Knowlton used the Leger Opinion online panel to survey 1,000 residents of Ontario aged 18+. The survey was completed between February 10th and February 17th 2025. Weighting was applied to ensure representation at an age, gender and regions of Ontario, based on 2021 census figures. No margin of error can be associated with a non-probability sample (i.e., a web panel in this case). For comparative purposes, though, a probability sample of 1,000 respondents would have a margin of error of ±3%, 19 times out of 20.

2Despite affordability challenges, majority of young Canadians see home ownership as a worthwhile investment, August 2024

3Those aged 18 to 38 or born between 1986 and 2006, and referred to as the next generation