Canadians living in the country’s largest urban centres face some of the highest real estate prices nationwide, making attaining home ownership status all the more challenging. Thanks to the post-pandemic permanence of remote working, however, moving to a smaller and more affordable city has become easier to achieve in these past few years. As the cost of living has drastically gone up, many urbanites are considering the move to other urban centres, particularly one city in Western Canada.

According to a recent Royal LePage survey of Canadians living in the greater regions of Toronto, Montreal and Vancouver, conducted by Hill & Knowlton,1 Edmonton is the top choice among respondents in the Greater regions of Toronto and Vancouver who would consider buying a property in one of Canada’s most affordable Canadian cities, if they were able to find a job or work remotely.

Among respondents in the GTA, 51% say they would consider purchasing a home in a more affordable city. The top choice among GTA respondents is Edmonton (19%), followed by Thunder Bay (15%) and St. John’s (14%). Similarly, in Greater Vancouver, 45% of respondents say they would consider purchasing a home in a more affordable city. The top choice among Greater Vancouver respondents is Edmonton (19%), followed by St. John’s (13%) and Thunder Bay (9%). Respondents were able to select more than one answer.

Among respondents in the Greater Montreal Area, 54% say they would consider purchasing a home in a more affordable city. The top choice among GMA respondents is Quebec City (29%), followed by Sherbrooke (15%) and Trois-Rivières (12%).

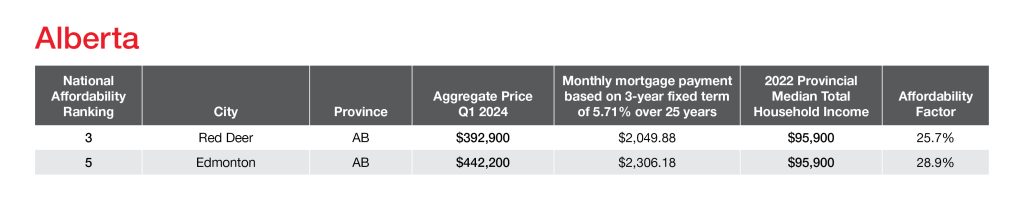

Out of the 15 most affordable cities in Canada identified by Royal LePage, two are in Alberta. Based on the percentage of income required to service a monthly mortgage payment, using provincial median household income data and city-level aggregate home price data,2 Edmonton ranks fifth among the most affordable cities in Canada, where 28.9% of a household’s monthly income would be required to service a mortgage payment. The mortgage calculation is based on a three-year fixed-term loan at 5.71%, amortized over 25 years with a 20% down payment.

Red Deer ranks third among the most affordable cities in Canada, and ranks first in the province of Alberta, where 25.7% of a household’s monthly income would be required.

“When shopping for a home, your dollars are bound to stretch farther in Edmonton than they would in most large urban centres in Canada. Here, a budget of $500,000 can get you a quality family-sized home on a sizable lot within proximity to desirable amenities,” said Ed Lastiwka, associate broker, Royal LePage Noralta Real Estate in Edmonton, Alberta. “Though our supply of homes has historically been plentiful, which has helped property prices remain stable, that has changed since the onset of the pandemic. Edmonton’s affordability has drawn many to the city in recent years, prompting more intense upward price pressure as demand outstrips supply.”

Lastiwka noted that interprovincial migration to Edmonton has increased since before the pandemic, with the majority of residents relocating from Ontario and British Columbia. This includes not only young families looking for an affordable location to put down roots, but also those seeking to take advantage of a lower cost of living during retirement.

“As Canadians continue to seek out an escape from congestion and seven-figure average home prices, Edmonton will be top of mind for many homebuyers willing to relocate,” said Lastiwka. “With approximately 100,000 people projected to move to the city within the next few years, home prices are expected to increase, yet remain relatively affordable.”

Looking for more information on the most affordable cities in Canada? Check out the Royal LePage 2024 Most Affordable Canadian Cities report.

1Hill & Knowlton used the Leger Opinion online panel to survey 900 Canadian residents, aged 18+, living in Canada’s three largest urban areas: Greater Toronto, Greater Montreal, and Greater Vancouver between May 13th and May 16th, 2024. No margin of error can be associated with a non-probability sample (i.e., a web panel in this case). For comparative purposes, though, a probability sample of 900 respondents would have a margin of error of ±3%, 19 times out of 20.

2Royal LePage’s Affordability Factor is based on the percentage of income required to service a monthly mortgage payment, using Statistics Canada 2022 provincial median total income of economic families and persons not in an economic family, and city-level aggregate home price data from the Royal LePage Q1 2024 House Price Survey. The mortgage calculation is based on a three-year fixed-term loan at 5.71%, amortized over 25 years with a 20% down payment.