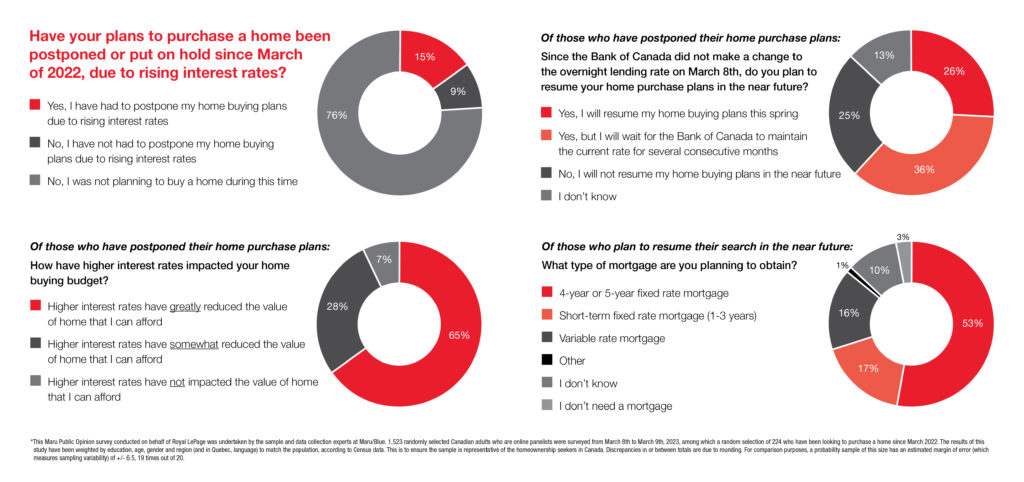

Climbing interest rates have given many Canadian homebuyers reason to pause their purchase plans over the last year. Nearly one quarter of Canadians (24%) were in the market for a new home this past year, and 63% of them say they postponed their plans due to rising rates, according to a recent Royal LePage survey, conducted by Maru/Blue.1 Now, with the Bank of Canada placing a hold on the overnight lending rate for the first time since March of 2022, many homebuyers intend to resume their purchasing plans once again. Of those who say they postponed their plans, 62% now intend to return to the market.

The survey found that more than a quarter (26%) of Canadians who put their home purchase plans on hold over the last year due to rising interest rates will resume their search this spring, following the Bank of Canada’s announcement last week to hold the overnight lending rate at 4.5%. Meanwhile, more than one third (36%) say they plan to move forward with their buying intentions, but will wait for the central bank to maintain the current rate for several consecutive months. Some 25% of those who postponed their home buying goals stated that they do not intend to resume their plans in the near future.

“Eight times a year, the Bank of Canada announces changes to its key interest rate, and for eight consecutive meetings, they aggressively raised rates in an effort to tame runaway inflation. On March 8th, 2023 they did nothing and doing nothing was a very big deal,” said Phil Soper, president and CEO, Royal LePage. “Based on our just-completed national survey, this was the signal that many Canadians were waiting for – an indication that it was safe to wade back into the housing market to search for the family home they so desperately want or need.”

Of the Canadians who stated that their home buying plans were postponed on account of the increased cost of borrowing, 65% report that higher interest rates have greatly reduced the value of home they can afford. Meanwhile, 28% of respondents say rates have somewhat reduced this value. Of those who chose to postpone their home purchase plans, two-thirds (67%) are between the ages of 18 and 34.

For those Canadians who intend to jump back into the housing market, many are gravitating towards a fixed rate mortgage, which can shelter homeowners from fluctuating interest rates. More than half (53%) say they would choose a four- or five-year fixed rate mortgage, and 17% say they would choose a short-term fixed-rate mortgage (1-3 years). Some 16% of respondents say they would opt for a variable rate mortgage.

“The Bank of Canada has indicated that it believes the rate hikes completed over the past twelve months are working their way through the economy, and that inflation should fall to three per cent by mid-year,” continued Soper. “While stating that they believe this period of rising rates is behind us, the bank qualified the statement, stating that if needed, it will increase rates again in the future. That said, it is unlikely we will see another period of back-to-back rate hikes in the near future.

“In recent weeks, well-priced properties in some popular neighbourhoods with low inventory have already seen multiple offers,” added Soper. “We anticipate that signs of stable economic conditions will lead to a more normalized spring market.”

Despite more pronounced economic challenges south of the border, Canada’s economy has remained stable throughout this period of correction. In the wake of the collapse of two U.S. banks, industry regulators are taking a cautiously optimistic approach, noting that while no bank is immune, Canadian financial institutions – even smaller ones – are more resilient to increased interest rates due to the strict federal regulations imposed upon them, as evidenced during the 2008 financial crisis when the Canadian housing market and its banking sector performed better than the U.S.

1This Maru Public Opinion survey conducted on behalf of Royal LePage was undertaken by the sample and data collection experts at Maru/Blue. 1,523 randomly selected Canadian adults who are online panelists were surveyed from March 8th to March 9th, 2023, among which a random selection of 224 who have been looking to purchase a home since March 2022. The results of this study have been weighted by education, age, gender and region (and in Quebec, language) to match the population, according to Census data. This is to ensure the sample is representative of the homeownership seekers in Canada. Discrepancies in or between totals are due to rounding. For comparison purposes, a probability sample of this size has an estimated margin of error (which measures sampling variability) of +/- 6.5, 19 times out of 20.